Get your financial house in order and prepare for the future.

Improve your financial behaviors with our expert guidance. Scroll down or click for class options.

Let our certified advisors help you achieve your dream

This unique financial capability program will help you take control over your finances, gain the capacity to absorb financial shock, help you develop a system to track to meet financial goals, and help you gain the freedom to make enjoyable choices.

Identify your financial goals

Create your action plan

Track your progress

Establish/rebuild your credit

Financial Literacy Classes

Register for a *FREE* virtual class

- April 16, 17, 18 – 5:30pm- 7:30pm

- May 21, 22, 23 – 5:30pm- 7:30pm

- June 25. 26, 27 – 5:30pm- 7:30pm

- July 16, 17, 18 – 5:30pm- 7:30pm

- August 20, 21, 22 – 5:30pm- 7:30pm

- September 17, 18, 19 – 5:30pm- 7:30pm

- October 22, 23, 24 – 5:30pm- 7:30pm

- November 19, 20, 21 – 5:30pm- 7:30pm

- December 17, 18, 19 – 5:30pm- 7:30pm

Upcoming Courses coming soon!

Financial Coaching

We make it easy for you to achieve your financial goals and independence. After completing the financial literacy course, you will participate in confidential one-on-one sessions with your specially-trained financial coach , who will help you:

- Identify your financial goals

- Create your action plan

- Track your progress

- Establish/rebuild your credit

- Make good financial decisions

- Get on the right path to becoming a homeowner

One-on-one Financial Coaching

Key Elements of Coaching:

- Content based on the client’s unique needs and goals

- A focus on long-term outcomes

- An ongoing, systematic, collaborative process for assisting clients to change financial behaviors

- Practice new behaviors with guidance

Financial Coaching Goals:

- Achieve client-defined goals

- Address immediate issues

- Support specific actions to meet goals

- Improve financial situations

- Change financial behaviors

- Facilitate decision-making

- Provide tools, resources, and referrals

Typical Coaching Activities:

- Alliance with client’s goals

- Set goals

- Develop action plan

- Identify resources, tools, and services

- Monitor client progress

- Make referrals as needed

can I create a wordpress post that disappears

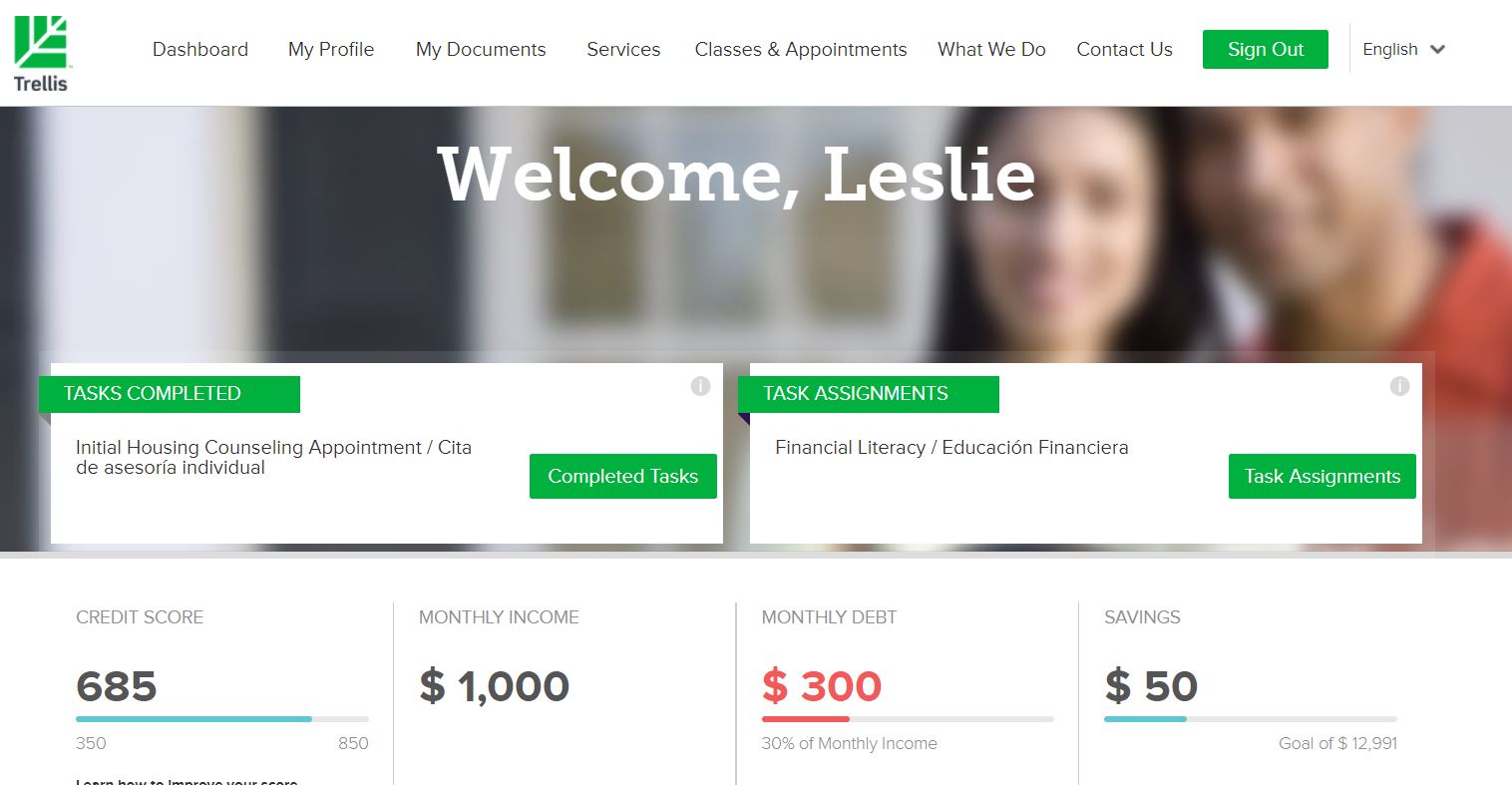

Easy to use customer portal.

Your time is valuable. Our customer portal allows you to schedule classes and appointments, upload documents and inquire about services that we offer–all at the tip of your fingers! You’ll be able to see your progress throughout the entire process.

We create affordable housing options to help bring people home

average credit score points increase

from financial capability participants

Average increase in savings

What’s happening at Trellis?

2024 December Financial Literacy class

Thank you for your interest in our December 2024 online Financial Literacy class. This is a FREE three-day class and each 2-hour session has a separate Zoom link. You must attend all three

2024 November Financial Literacy class

Thank you for your interest in our November 2024 online Financial Literacy class. This is a FREE three-day class and each 2-hour session has a separate Zoom link. You must attend all three

2024 October Financial Literacy class

Thank you for your interest in our October 2024 online Financial Literacy class. This is a FREE three-day class and each 2-hour session has a separate Zoom link. You must attend all three